Another Major Forgery Ring has Been Exposed—This Time in Rome

How long can the blue-chip art market survive the forgery boom?

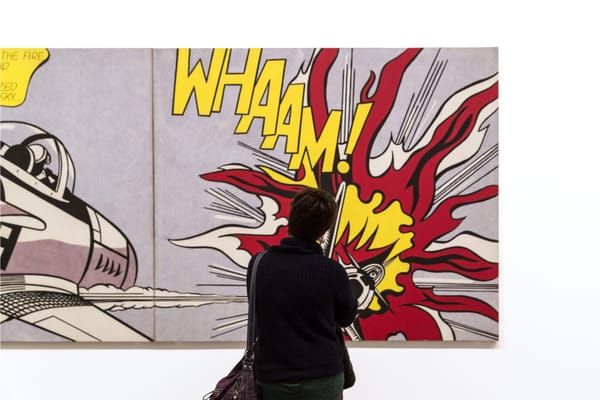

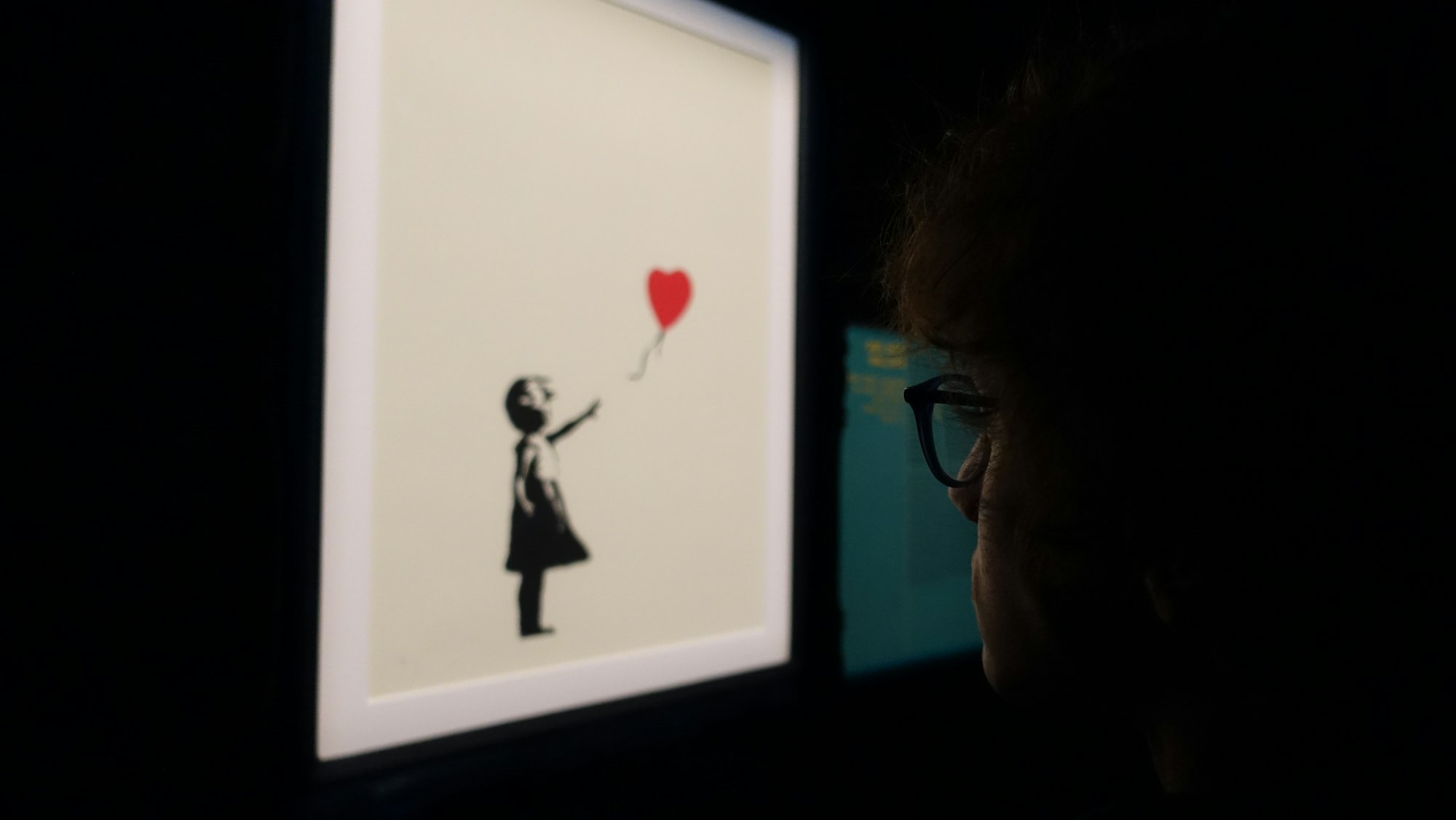

Another European-wide forgery ring has been exposed, this time in Rome, where Italian authorities seized 71 counterfeit paintings falsely attributed to blue-chip names like Picasso, Rembrandt, Banksy, and Warhol. Investigators discovered a clandestine workshop stocked with art materials, forged certificates of authenticity, and catalogues designed to market these fraudulent pieces. The scale of the operation, reminiscent of a recent Europe-wide forgery network that infiltrated auction houses and even staged fake exhibitions, raises urgent questions about the resilience of the high-end art market.

The blue-chip sector has long thrived on exclusivity, prestige, and the assumption that each piece carries an unshakable provenance. But with forgers operating at an increasingly sophisticated level, the cracks in this foundation are beginning to show. If buyers start doubting authenticity—even at major sales—will confidence erode enough to bring prices down? Unlike a financial market correction, where value fluctuations are expected, a collapse in trust within the art world could have longer-lasting consequences.

For decades, multimillion-dollar pieces have functioned as safe-haven assets, bolstered by the belief that they will appreciate indefinitely. That belief depends on an unspoken contract between artists, collectors, and institutions: what you’re buying is real, unique, and indisputably connected to its creator. But when forgeries flood the secondary market, when major artists’ works appear in police raids instead of museum retrospectives, that certainty starts to falter. If high-net-worth collectors hesitate, fearing even blue-chip works are vulnerable to fraud, could we see a slowdown in demand—and an eventual dip in valuations?

For now, authentication firms, auction houses, and galleries will rush to reassure their clientele. But the implications stretch beyond individual sales. If forgeries keep slipping through, if even well-established institutions are fooled, the question won’t be whether a single piece is real—it will be whether the entire market can still justify its soaring prices.

ART Walkway News