Art Investment: The Truth About Fractional Ownership

Fractional ownership is reshaping the art market, but does it offer real connection to the artwork—or just another financial play?

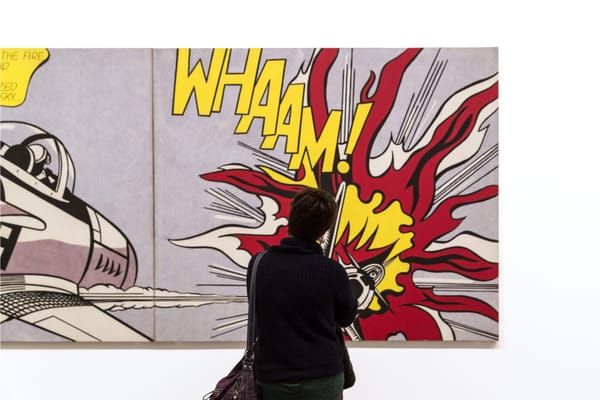

Have you noticed a surge in platforms offering you the chance to buy “shares” of a famous painting? That’s fractional ownership, a new trend claiming to democratize the art world by splitting a pricey masterpiece into smaller, more affordable parts. At first glance, it sounds great—finally, you can own a piece of a Warhol without dropping millions. But is it really that simple?

Let’s break it down: Typically, a third-party platform acquires or tokenizes a painting, then sells “fractions” to multiple buyers. You get a digital certificate or token representing your share, while the physical artwork remains locked away in a gallery or storage facility. Some platforms promise you a say in how the piece is exhibited, but others only let you watch from afar. In any case, you’re part-owner of a real artwork—at least in theory.

Here’s the catch: Unlike traditional investing, fractional ownership in art isn’t regulated like stocks or bonds. Who handles insurance and storage? How do you sell your share if you want out? And, crucially, does co-owning a painting actually deepen your connection to the art, or is it mostly a financial stake? Some collectors worry that slicing up a masterpiece into dozens of pieces robs it of its cultural mystique.

That said, many find fractional ownership thrilling. If you’ve always dreamed of having a stake in a famous painting but can’t afford seven figures, it’s a chance to be part of that story. Plus, blockchain technology often underpins these transactions, potentially adding transparency around provenance and authenticity. You might even build relationships with fellow collectors who share your piece—an unexpected social angle in the normally exclusive art world.

Fractional Ownership Could Reshape How the Next Generation Collects and Appreciates Art

If it catches on, galleries and auction houses might need to adapt. Already, some big-name auctioneers have experimented with partial sales, eyeing younger or smaller-scale investors. Others remain skeptical, questioning whether a painting has the same aura when “owned” by 1500 strangers.

So, before you dive in, consider the practicalities:

- Who controls the physical artwork?

- What’s your exit plan if you want to sell your fraction?

- Are you buying because you love the art or betting on market gains?

In the end, fractional ownership might be the gateway for more people to engage with fine art, shifting it from an elitist pursuit to something more inclusive. Or it could become another hype-laden fad that fizzles. For now, be curious—but be cautious. If it elevates your appreciation of art, it may be worth exploring. If it feels purely like a speculative gamble, maybe step back and ask: is this the right way to connect with a masterpiece I admire?

ART Walkway News